In the digital age, investing in the financial markets has become more accessible and convenient than ever before. One promising avenue for investors in Pakistan is the SRA App.and in this artical i will tell you How To Invest In SRA App In Pakistan

In this article, i will guide you through the process of How To Invest In SRA App In Pakistan, providing valuable insights and tips for a successful investment journey.

Section 1: Understanding About SRA Investment

What is SRA App?

The SRA App, short for “Smart Resource Allocation,” is a cutting-edge financial platform designed to empower Pakistani investors. This app offers a range of features and functionalities to help you manage your investments efficiently.

Benefits of Using SRA App

Investing in the SRA App can yield various advantages, including potential returns that outperform traditional investment options. Let’s explore why this platform is gaining traction among Pakistani investors.

Section 2: Prerequisites for Investing

Legal Requirements

Before diving into the world of SRA App investments, it’s crucial to understand the legal framework and compliance standards. Ensure that you meet the eligibility criteria to start your investment journey.

Financial Readiness

Assess your financial readiness by evaluating your investment capacity, setting a budget, and determining your risk tolerance. This step will help you make informed investment decisions.

Section 3: Research and Due Diligence

Market Analysis

A comprehensive understanding of the Pakistani market and its dynamics is essential. Identify competitors and market trends to make informed investment choices.

SRA App Performance

Before investing, analyze the SRA App’s past performance and user reviews to gauge its reliability and suitability for your investment goals.

Risk Assessment

Identify potential risks associated with SRA App investments and develop strategies to mitigate them. A well-thought-out risk management plan is crucial for long-term success.

Section 4: How to Invest in SRA App

Account Setup

Learn how to create an account on the SRA App and complete the verification process. A secure and verified account is the first step toward investing.

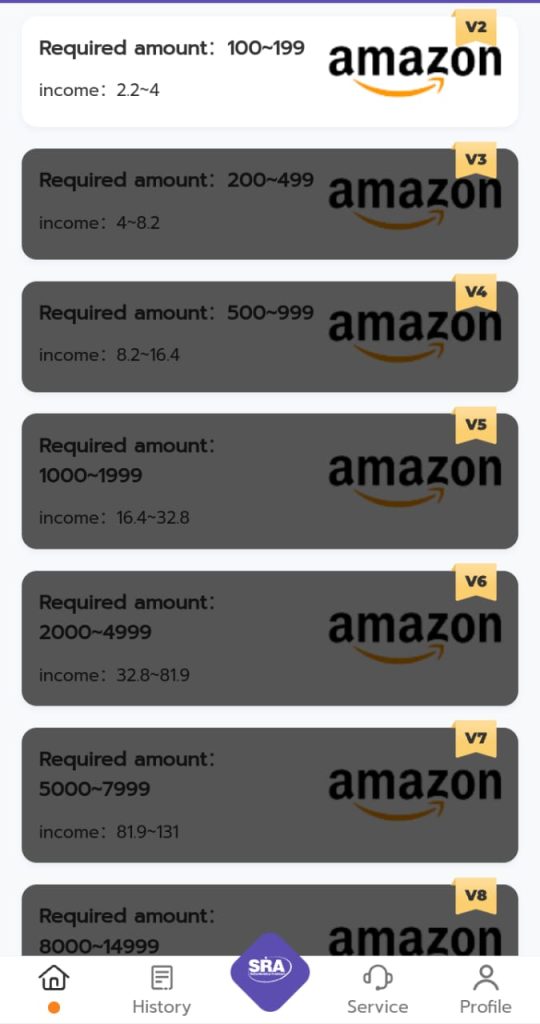

Funding Your Account

Explore various deposit options and understand the minimum investment requirements. Ensure you have adequate funds to start your investment journey.

Investment Strategies

Discover different investment options available on the SRA App, such as stocks, bonds, and mutual funds. Explore the concept of diversification to minimize risk.

Monitoring Your Investments

Use tracking tools and resources provided by the SRA App to monitor your investments effectively. Set clear investment goals to stay on track.

Section 5: Security and Safety Measures

Protecting Your Investments

Implement security measures such as two-factor authentication and secure password practices to safeguard your investments from unauthorized access.

Fraud Prevention

Learn how to identify phishing attempts and report suspicious activities promptly. Protecting your account from fraud is paramount.

Section 6: Tax Implications

Taxation on Investments

Understand the tax implications of your investments, including capital gains tax and withholding tax. Comply with tax regulations to avoid legal issues.

Tax Planning

Explore tax planning strategies to minimize your tax liability legally. Seeking professional advice can be beneficial in this regard.

Section 7: Exit Strategies

Selling Investments

When the time comes to liquidate your assets, know how to do so efficiently. Timing and considerations play a vital role in this process.

Reinvestment Options

Consider reallocating funds and explore opportunities for compound returns when exiting investments.

Section 8: Common Pitfalls to Avoid

Emotional Investing

Avoid impulsive decisions and maintain discipline in your investment approach. Emotional investing can lead to poor choices.

Overtrading

Manage transaction costs and choose between long-term and short-term investment strategies wisely.

Conclusion

Investing in the SRA App in Pakistan holds immense potential for those looking to grow their wealth. By understanding the platform, conducting thorough research, and following best practices, you can embark on a successful investment journey that aligns with your financial goals. Take the first step towards a brighter financial future with the SRA App today.